- Published on

Maximize Your Savings: Mastering the Tax Impact of Certificate of Deposit Rates

Maximize Your Savings: Mastering the Tax Impact of Certificate of Deposit Rates

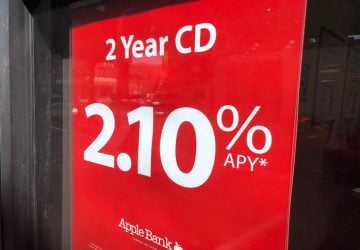

Placing your funds into Certificates of Deposit (CDs) can be a dependable method for enhancing your savings, though it is essential to recognize how the interest from CDs affects your taxes. Despite being typically taxable, certain tactics can help you adjust your tax liabilities more favorably. In this detailed guide, we delve into such tactics, equipping you with the knowledge to deftly manage the tax aspect of CD interest rates, with the potential to lessen the taxes owed and boost the returns you keep after taxes.

The initial step in dealing with CD interest and taxes involves proper income declaration. Financial institutions report the interest you've accumulated from CDs directly to the IRS and furnish you with a Form 1099-INT. Reporting this income accurately on your tax filings is critical; omitting it could trigger IRS penalties. Hence, adhering to tax reporting norms is necessary for full compliance. Tax-Advantaged Investment Options Allocating funds into tax-advantaged instruments such as Individual Retirement Accounts (IRAs) or 401(k) plans when investing in CDs can substantially enhance the tax effectiveness of your earnings. Traditional IRAs and 401(k) plans offer tax-deferred growth, so that taxes on interest gains are postponed until the funds are taken out during retirement. Roth IRAs, conversely, provide the luxury of tax-exempt withdrawals. Investing in CDs via these accounts means enjoying these perks, likely leading to a decreased tax obligation. CD Investment in Short-Term Goals Considering CDs for short-term fiscal ambitions can involve using standard savings accounts or money market accounts, where the accrued interest might benefit from more attractive tax handling or could be taxed at a lower bracket compared to typical CDs. This method may enhance your chances of achieving short-term aims in a way that's more tax-efficient, possibly leading to a diminished tax bill. Understanding State Taxes Take note that state taxes can apply to interest income on top of federal taxes, with state tax laws differing greatly. It's important to investigate and comprehend the tax rules specific to your state to fully grasp any extra tax obligations linked to CD interest. An informed approach to state tax laws aids in effective investment decisions and tax duty management. Strategizing CD Maturity for Tax Purposes The interest earned on a CD is usually taxable in the year the CD matures. If your CD portfolio consists of a ladder system with staggered maturity dates, you can distribute your tax liabilities across several years. This way, your tax payments can be spread out, potentially leading to a lighter tax load overall. Mastering the way CD rates influence taxes can aid in shrinking your tax responsibilities while enlarging the amount of returns you receive after taxes. Taking advantage of tax-favorable accounts, understanding state-specific tax legislations, and implementing approaches like CD laddering are crucial for tax planning. Informed investing decisions will help you handle CD investments tax-efficiently, thus preserving more of your earnings.